The Employees’ Old-Age Benefits Institution (EOBI) is a prominent organization in Pakistan that provides various pension schemes for workers. Established to ensure financial stability for retirees, the EOBI pension system includes several benefits such as the old age pension, old age grant, and invalidity pension.

EOBI Login

These schemes are funded through the EOBI pension fund, which is primarily financed by contributions from employers and employees based on minimum wages. As a form of compulsory social insurance, EOBI aims to secure the welfare of the workforce, offering essential support to individuals during their retirement years.

EOBI (Employees’ Old-Age Benefits Institution)

The EOBI was founded on April 15, 1976, by the federal government of Pakistan to provide social security benefits to workers.

| Name of Institution | EOBI (Employees Old-Age Benefits Institution) |

| Pension Month | November 2025 |

| Proclaimed Date | 1st April 1976 |

| Region | Pakistan |

| Cause of Enforce | Providing Social Insurance to Old-Age Employees |

| Law Act | Article 38 (C) |

| Minimum Threshold of Pension Amount | Rs. 10,000/- |

| Max. Pension | As per Formula |

| Chairperson | Mr. Azhar Hameed |

| Headquarters | Karachi, Pakistan |

EOBI operates under a system where contributions are collected from employers and employees based on their average monthly wages, ensuring that insured persons receive support upon retirement.

The organization manages EOBI pension disbursement, ensuring timely and accurate payments to beneficiaries. Pensioners who have contributed for less than fifteen years are eligible for different benefits compared to those with longer contribution periods.

EOBI offers a life pension and monthly pension plans, providing financial stability to retirees throughout their lives.

EOBI Pension Types in 2025

EOBI is offering four types of pensions in 2025. Here is a detailed overview of each type of EOBI pension.

Old Age Pension

The Old Age Pension is a key benefit provided by EOBI, designed to support insured persons collection. It becomes available once an individual reaches the superannuation age and has completed at least 15 years of insurable employment. Also, for a mine worker, the age limitation is 55. This payment provides a monthly pension to ensure financial security during retirement.

Old Age Grant

The Old Age Grant is a one-time lump sum payment for individuals who have not met the minimum requirement of 15 years of months of insurable employment but have reached the superannuation age.

This grant helps to offer some financial relief to those who were part of the insured persons collection but do not qualify for the Old Age Pension.

Survivor Pension

The Survivor Pension, also known as the survivors pension, provides financial assistance to the family of a deceased insured person.

It is primarily aimed at the surviving spouse and dependent children (not for minor children), ensuring they receive a regular monthly pension to help sustain their livelihood after the loss of the family breadwinner.

Invalidity Pension

The Invalidity Pension is available to insured persons who are no longer able to work due to a permanent disability and have a minimum of five years of insurable employment.

This EOBI fund provides a monthly pension to support individuals who can no longer earn a living due to their disability, ensuring they have a source of income despite their inability to work.

EOBI Qualification Criteria 2025

Not sure what the qualification criteria are to be an EOBI-insured person? I will share all the EOBI pension rules in Urdu and English. So all the applicants can get complete details and a guide about EOBI’s pension scheme registration.

- An employee must be working in a private sector where at least 5 employees are working.

- ایک بیمہ دار شخص جو نجی سیکٹر میں کام کرتا ہے جیسے کے کارخانوں، ملوں یا کسی دوسرے قسم کے پیشہ ورانہ میدانوں میں، جہاں کم از کم پانچ ملازمین کام کرتے ہوں۔

- Men and women are both appropriate.

- مرد اور عورت دونوں جنسیں مناسب ہیں۔

- Age limit for men is 60 years while for women it is 55 years.

- ملازم کی عمر مردوں کی صورت میں 60 سال سے کم ہونی چاہئے اور عورتوں کی صورت میں 55 سال سے کم ہونی چاہئے۔

- The insured employees must be a part of EOBI for at least 15 years.

- بیمہ شدہ ملازمین کو کم از کم 15 سال تک ایوبی آئی کا حصہ ہونا چاہئے۔

Check EOBI Pension Online by CNIC (EOBI card check karne ka tarika)

Here is the step-by-step guide to checking your EOBI pension online using the EOBI web portal. Check this EOBI card check karne ka tarika:

- Go to the official web portal of the gov website from here.

- Do EOBI login with a new NIC.

- Now click on the green arrow button to check your details.

- Here you can manage and see all of your transactions for all the previous months.

EOBI Pension Contribution Details

EOBI payment total contribution from the insured person and the employer of the insured person as well.

Employers are responsible for paying 5% of the minimum salary prescribed by the government and employees need to pay 1% of their minimum salary.

Also, this is the 50% of the pension payment that the EOBI pensioners and employees will collect, while the other 50% will come from the government of Pakistan.

- 5% of the minimum wages (Rs. 13000/) from the employer’s contribution (Rs.650/-)

- 1% of the minimum pay (Rs. 13000/-) from the insured person (Rs. 130/-)

- The sum of both contributions will be subtracted from the monthly salary.

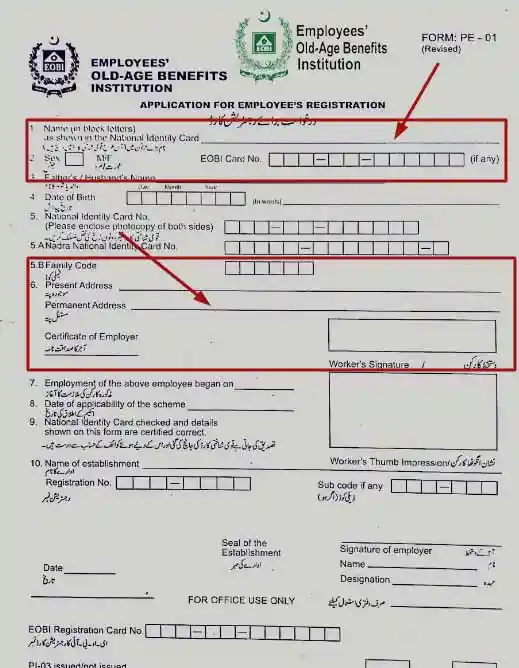

EOBI Registration for New Employees

So here comes the most crucial thing which is the registration process for EOBI. Since the institution is only for old age employees so it’s become kind of hard to know where to register yourself.

But as we always say, you don’t need to worry at all. In this write-up, we are going to explain every point for successful registration.

Currently, there is no way to sign up for this employee’s allowance organization. However, the only way to register yourself is through a form proposal in your local EOBI office. So let’s start with the procedure guidelines.

- The very first step is to download a registration form which is “Form PE-01”

- Go to your browser and type www.eobi.gov.pk

- Now Click on the forms and navigate to the form page

- On the form page, you can download the PE-01 form

- Once downloaded, you can now fill out the form and submit it to the regional EOBI office

So this is the procedure to apply for EOBI and further, we are going to explain how to fill out the form and who can apply for this program.

After registration, you can login to your account and check your EOBI status.

F.A.Q

Who can get the EOBI fund?

All the Commercial Organizations where the EOB act is applicable provide the EOBI payments to their EOBI pensioners.

Where EOBI is applicable?

EOBI applies to all Pakistan employees except those working in the Armed forces and statutory bodies.

Can a surviving spouse get the EOBI pay?

Yes, the surviving spouse can get this payment if the parents are not alive.

Can EOBI funds paid to parents?

Yes, funds can be paid to parents after the death of the pensioner.

What is the pension increase notice 2025?

The National Assembly of Pakistan finally got a notification from the EOBI officials about the increase in pension payments.